Pattaya is overbuilt — yet they keep building. Construction sites everywhere! It’s crazy.

All these buildings: half‑empty. Many units unsold.

“Never, ever buy property in Thailand. The weather’s too warm. The Thais don’t even speak English. And the food? Way too spicy! Can I have another beer, please? What time does Happy Hour finish?”

Don’t we all know them?

The bar-lawyer army. The grumpy & negative keyboard-warriors on social media?

“Property Experts”, pur sang?

Facts:

- They keep building.

- Buildings (seem) half empty.

- The weather is warm.

- Thais speak better English than most of us speak Thai.

- Thai food can be spicy.

- Happy hour never finishes if you have a smile on your face.

The Condo Boom

For more than a decade, the Pattaya real estate market showed blooming sales — mostly condos in resort‑style “waterpark” lagoon projects.

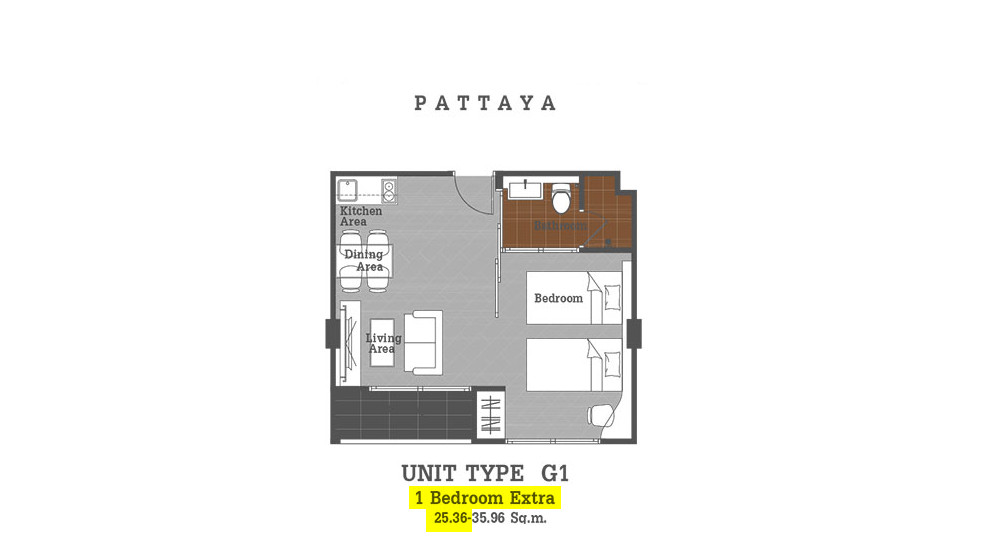

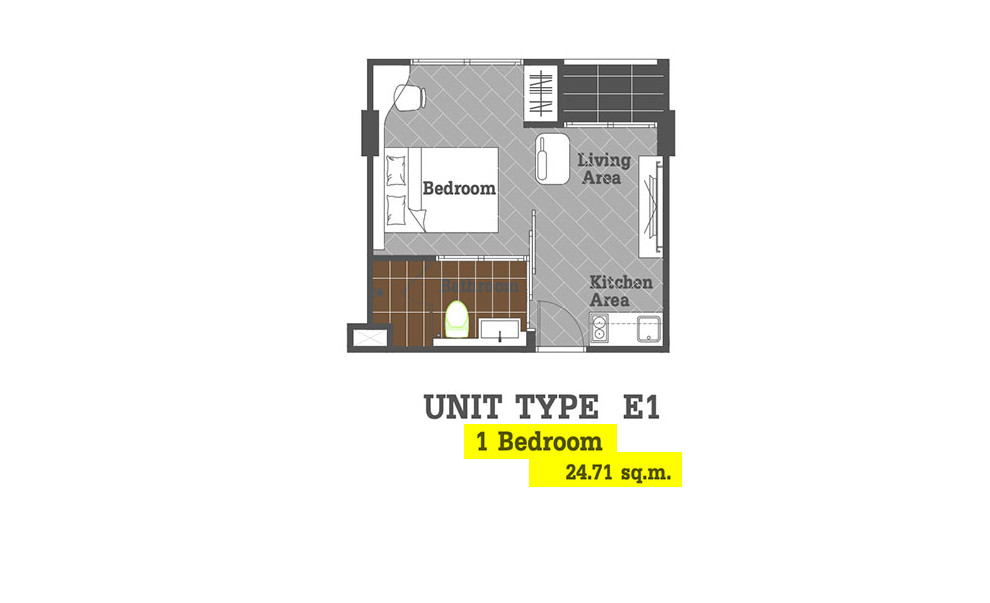

Average room size? Starting from 25ish square metres upwards.

In some developments, a 25–30 sqm room would be marketed as a glamorous 1‑bedroom unit. To join this “desirable and privileged world” you’d invest from roughly ฿ 1 million [€ 26,000 | $ 32,000 | £ 23,000].

For comparison: a covered parking lot in central Amsterdam will set you back € 89,000 — nearly ฿ 3.4 million — plus € 150 (฿ 5,700) monthly service fee.

Bigger = Better?

Maybe. But also more expensive.

Higher construction costs mean higher sales prices. A logical step to reduce price — and widen your audience — is to create smaller units.

What’s “small”? An average 5‑star hotel room is 32–34 sqm, yet with smart layouts they feel bigger.

Holiday Inn Express on Soi Buakhao? 19 sqm. The new 5‑star Marriott Courtyard in Wong Amat? Starts at 35 sqm.

When Town & Country Property built The Residence Jomtien (2007), studios were 51 sqm. In today’s Pattaya property market, that could easily be a 2‑bedroom apartment…

Why Sell Smaller Units Cheap?

It’s a numbers game. There are more buyers with ฿ 1 million to spend than buyers with ฿ 5 million.

But are they really “cheap”?

Example: Chapter One ECO Ratchada – Huaikwang (Bangkok), 1,844 units sold out, starting at ฿ 2.89 million. That’s ฿ 120,000 per sqm for 24 sqm units — 30% higher than other projects in the same area.

From a developer’s point of view: selling small units at an affordable starting price can be very lucrative. Do the math.

🔗 Related Reading

Back to Pattaya

Who’s buying? Most “affordable” mini‑apartments (shoeboxes) go to:

-

Foreigners who frequently visit Thailand

-

Thai starters buying into projects from LPN or Q‑House with attractive bank mortgages

Many units sit empty most of the year, bought as an “alternative hotel room”. Frequent travellers use their own apartment whenever they’re in Thailand. Pure convenience.

Living in the Dark

Pass a condo resort‑style project at night and you might see a huge building with just a few lights on. “Living in the dark.”

Any Concerns?

Not really. Nobody bought these units as “buy‑to‑let” investments — only for personal use.

Inflation? Deflation? No one worries — units were bought with disposable cash, cheaper than a parking lot back home.

And They Keep Building…

True. But developers don’t build without sales.

A high‑rise takes 2–3 years to complete. Once enough sales are achieved and the chart is dotted with “sold” stickers, money’s in the bank — construction begins. COVID or not.

Is there anybody “left in the dark”?

Any more questions? No?

Happy Hour can continue!

Author: Mr. KC Cuijpers

For more information: Please contact Town & Country Property – [email protected]